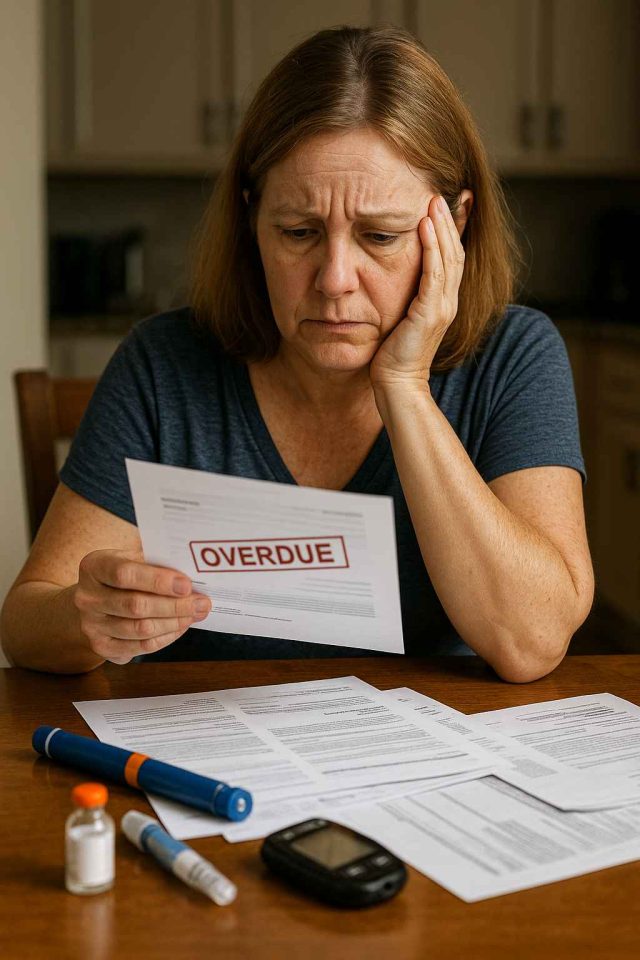

Managing diabetes isn’t just a medical challenge—it’s a financial one. Imagine paying out-of-pocket for insulin, glucose monitors, emergency care, and specialist visits every month. For many, the struggle of managing diabetes and debt is a harsh reality that compounds their health concerns. But why does a chronic condition like diabetes so often lead to financial instability? The answer lies at the intersection of rising drug prices, insurance gaps, and socioeconomic disparities.

Table of Contents

- The Rising Cost of Diabetes Care in the U.S.

- How Debt Impacts Diabetes Management

- Insulin Access, Branded Drugs, and Financial Stress

- Solutions, Advocacy, and Navigating Financial Resources

- Conclusion & FAQs

The Rising Cost of Diabetes Care in the U.S.

In the United States, managing diabetes comes at a steep price. The American Diabetes Association estimates the average cost of diagnosed diabetes is over $16,000 annually per person, with direct medical costs accounting for nearly 70% of that figure. This economic burden is even heavier for individuals without comprehensive health insurance.

The costs are not limited to insulin alone. Patients often need test strips, glucose monitors, continuous glucose monitoring systems (CGMs) like the Dexcom G7, and medications like Ozempic or Trulicity. Many of these tools are essential—not optional—and skipping doses or delaying care to save money can have dangerous consequences.

Even those with insurance can face high deductibles and copays, particularly for brand-name diabetes drugs. A person who earns too much to qualify for Medicaid but too little to comfortably afford insurance often falls into what’s called the “coverage gap.” As a result, they may rely on credit cards or payday loans to pay for treatment, creating a snowball of medical debt.

A recent study published in Health Affairs shows that nearly one in four people with diabetes struggle to pay medical bills. Unsurprisingly, this has sparked a conversation about whether the healthcare system adequately supports those with chronic illnesses. For additional context, you can read similar insights on Diabetes in Control’s article archive.

How Debt Impacts Diabetes Management

When debt piles up, so does stress—and stress is no friend to blood glucose control. Financial strain can lead to poorer diet, skipped doctor appointments, and emotional burnout. In turn, these factors contribute to poor glycemic management and increase the risk of complications such as neuropathy, vision loss, and kidney disease.

A Cycle of Stress and Instability

Living with diabetes already requires daily attention. Adding financial instability to the mix makes it much harder to maintain consistent care. Patients who delay filling prescriptions due to cost might experience dangerous blood sugar fluctuations. Over time, such patterns can lead to more ER visits, hospitalizations, or even amputations—outcomes that come with both human and financial costs.

In some cases, patients are forced to choose between rent, groceries, or diabetes care. These trade-offs reflect a systemic failure to protect the most vulnerable. Moreover, caregivers and family members often share this burden, creating a ripple effect that reaches beyond the individual patient.

Notably, younger adults with type 1 diabetes are more likely to experience high out-of-pocket costs, especially those transitioning off parental insurance. As a result, early-career professionals may enter adulthood with mounting diabetes and debt, limiting their financial and personal growth.

Insulin Access, Branded Drugs, and Financial Stress

Insulin remains one of the most visible flashpoints in the conversation around diabetes affordability. Despite being discovered over a century ago, insulin remains prohibitively expensive for many in the U.S. This is especially concerning given that it’s a life-sustaining drug for people with type 1 and some with type 2 diabetes.

Branded Medications and Price Disparities

Popular branded insulins such as Lantus, Humalog, and NovoLog are among the most expensive diabetes medications. While manufacturers like Lilly and Novo Nordisk have launched affordability programs, many patients either don’t know they exist or don’t qualify. Meanwhile, newer GLP-1 receptor agonists like Mounjaro and Rybelsus—though effective—come with price tags of $800–$1,200 per month if uninsured.

These high prices feed into larger issues of prescription abandonment, where patients walk away from pharmacies without picking up their medication. This not only worsens health outcomes but also leads to higher long-term costs for the healthcare system as untreated conditions escalate.

According to a report from KFF, more than 40% of Americans with diabetes report rationing insulin. Such behaviors are not the result of negligence but of desperation. If you’re struggling with access to care or treatment advice, consider seeking help from trusted sources like Healthcare.pro.

Solutions, Advocacy, and Navigating Financial Resources

Although the link between diabetes and debt is troubling, there are actionable steps that patients, providers, and policymakers can take to mitigate this burden.

Patient Assistance and Community Support

Many pharmaceutical companies offer patient assistance programs (PAPs) that provide free or discounted medications to qualifying individuals. Nonprofit organizations like the Diabetes Patient Advocacy Coalition (DPAC) also offer education on legislative solutions and patient rights.

In some communities, Federally Qualified Health Centers (FQHCs) provide affordable care regardless of insurance status. These centers often have certified diabetes educators, registered dietitians, and case managers who can help patients navigate their options.

Telehealth has also expanded access, reducing transportation barriers and missed workdays. Virtual care platforms can deliver follow-up services and glucose monitoring support at a lower cost than in-person visits.

Policy and Pricing Reform

On the legislative front, there’s growing momentum to cap insulin prices and improve transparency in pharmaceutical pricing. Several states have already passed laws capping insulin co-pays, and federal proposals aim to make this a nationwide policy.

Employers and health plans are also being urged to include broader access to diabetes care in their formularies. Advocacy plays a key role here—healthcare professionals and patients alike must continue to push for a more equitable system.

Campaigns like “Affordable Insulin Now” are gaining traction, shining light on personal stories and policy solutions. To stay updated on advocacy efforts, follow publications like Diabetes in Control that regularly report on these developments.

Conclusion & FAQs

The connection between diabetes and debt is both deeply personal and broadly systemic. From high medication costs to financial trade-offs that endanger health, the impact is far-reaching. However, with the right support systems, policy changes, and education, we can work toward a future where managing diabetes doesn’t mean risking financial ruin.

FAQs

Why is insulin so expensive in the U.S.?

Insulin prices are high due to limited generic competition, market exclusivity, and a complex supply chain involving pharmacy benefit managers and insurers.

What financial help is available for people with diabetes?

Options include patient assistance programs, co-pay cards, nonprofit resources, and community health clinics. Speaking with a caseworker or diabetes educator can help.

How does debt affect diabetes outcomes?

Financial stress can lead to skipped appointments, poor diet, and reduced medication adherence, all of which worsen health outcomes.

Are GLP-1 medications covered by insurance?

Coverage varies. While drugs like Ozempic and Mounjaro may be covered under some plans, others require prior authorization or have high copays.

Where can I find reliable support for managing diabetes costs?

Sites like Healthcare.pro and Diabetes Patient Advocacy Coalition offer tools and advice for accessing affordable care and medication.

Disclaimer

This content is not medical advice. For any health issues, always consult a healthcare professional. In an emergency, call 911 or your local emergency services.