Pharma TV Ads were once the gold standard of pharmaceutical marketing. Decades ago, a prime-time commercial could spark patient demand almost overnight. Today, however, the story is very different. Patients may still watch, but the conversion rates aren’t what they used to be. Why is this happening, and what lessons can pharma marketers learn? Much like blockbuster drugs that eventually face generic competition, even the once-mighty Pharma TV Ads are losing their edge.

Table of Contents

- The Rise and Decline of Pharma TV Advertising

- Shifts in Patient Behavior and Media Consumption

- Regulatory Challenges and Ad Fatigue

- Digital Alternatives Driving Higher ROI

- Conclusion

- FAQs

The Rise and Decline of Pharma TV Advertising

Pharma TV Ads gained prominence in the late 1990s when the FDA relaxed rules around direct-to-consumer (DTC) marketing. Branded drugs like Lipitor, Humira, and Viagra became household names not just for their clinical benefits but also because of their ubiquitous commercials. Back then, patients absorbed health information from television, often with little outside comparison.

However, the conversion power of these ads began to decline as consumer behavior changed. People no longer rely solely on what they see during commercial breaks. Instead, they use Google, YouTube, and medical forums to fact-check claims in real time. Patients who once called their doctors after seeing a glossy TV ad now cross-reference with independent sources, from WebMD to Healthcare.pro.

Pharma TV Ads have also become less unique. Saturation has led to formulaic messaging: smiling patients in sunny parks, doctors in white coats, and rapid-fire disclaimers. What was once fresh now feels repetitive, making it harder to break through consumer skepticism.

Shifts in Patient Behavior and Media Consumption

In today’s healthcare landscape, audiences are fragmented across countless digital platforms. Viewers, especially younger generations, are cutting the cord. Streaming platforms like Netflix and Disney+ offer ad-free experiences, reducing the sheer number of eyeballs that traditional TV campaigns reach. Even when ads air, DVRs and streaming options allow viewers to skip them.

Patients have also become more digitally empowered. A potential patient might hear about a drug such as Keytruda or Ozempic from a commercial, but the decision to act is usually shaped online. They search for clinical trial results, patient testimonials, or cost comparisons before making an appointment. This shift makes Pharma TV Ads more of an awareness tool rather than a direct driver of prescriptions.

The pandemic accelerated telehealth and digital adoption. Patients became accustomed to online consultations and health apps, further reducing their reliance on television for medical decision-making. As EHealthcare Solutions notes, digital advertising now offers targeted reach and performance tracking that TV simply cannot match.

Regulatory Challenges and Ad Fatigue

Pharma TV Ads have always carried a heavy regulatory burden. The “fair balance” requirement forces advertisers to list risks alongside benefits, often in fast, confusing disclaimers. Over time, this created an almost comical effect. Patients remember the warnings more than the brand message.

Another factor is ad fatigue. According to Nielsen, the average viewer is exposed to thousands of brand messages daily. When pharma ads recycle the same imagery—grandparents tossing frisbees, couples biking at sunset—they blur together. As a result, they lose persuasive power.

Moreover, increased scrutiny from both regulators and advocacy groups has made companies cautious. Instead of bold campaigns, many brands produce “safe” but uninspiring ads. Safe does not always sell. In contrast, targeted digital ads allow for personalization without sacrificing compliance, giving marketers more room to innovate than a thirty-second TV spot allows.

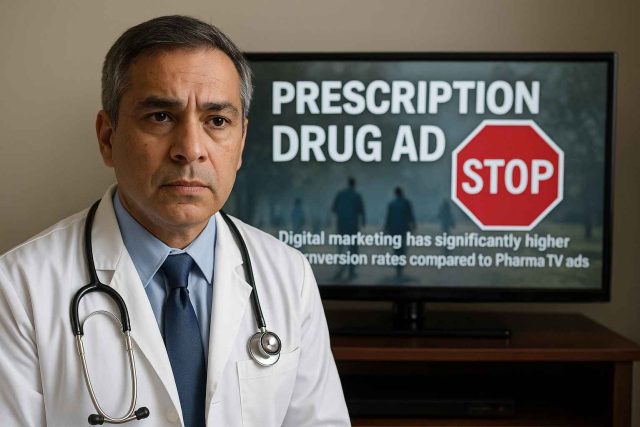

Digital Alternatives Driving Higher ROI

While Pharma TV Ads struggle, digital marketing strategies are thriving. Paid search, social media, and programmatic advertising offer precise targeting by demographics, condition, and even browsing behavior. Unlike TV, digital platforms provide real-time analytics, helping pharma brands measure conversions and optimize campaigns instantly.

Podcasts, webinars, and influencer partnerships are also becoming staples. For example, disease-specific podcasts allow companies to speak directly to niche patient populations in ways that TV cannot. Similarly, sponsored articles on trusted healthcare platforms such as Pharma Marketing Network reach engaged professionals who influence patient decisions.

Personalization is the strongest advantage. With retargeting, a patient who reads about HIV treatments online may later see tailored digital ads about PrEP or Biktarvy across multiple platforms. This multi-touch approach boosts credibility and engagement.

While TV ads may still serve as broad awareness drivers, they are less cost-efficient compared to digital. In an era where marketing budgets face increased scrutiny, executives prioritize ROI. For many, that means shifting dollars away from TV and toward measurable, digital-first strategies.

Conclusion

Pharma TV Ads are no longer the conversion powerhouse they once were. Consumer behavior has shifted to digital-first research, regulatory demands have diluted messaging, and ad fatigue has set in. Yet the decline of TV advertising is not the end of pharmaceutical marketing—it is a pivot point. By embracing digital channels, personalized content, and transparent engagement, pharma marketers can thrive in this new environment.

FAQs

Why are Pharma TV Ads less effective today?

They face fragmented audiences, digital-first patients, and ad fatigue, making it harder to convert viewers into patients.

Do Pharma TV Ads still work for awareness?

Yes, they still raise awareness, but they are less effective at driving direct conversions compared to digital marketing.

What are better alternatives to TV advertising?

Digital strategies such as paid search, social media ads, influencer campaigns, and webinars deliver higher ROI and targeting.

How has the pandemic affected pharma advertising?

It accelerated digital adoption and normalized telehealth, further reducing reliance on television campaigns.

Should pharma companies stop using TV ads completely?

Not necessarily. TV can complement digital campaigns, but it should no longer dominate marketing budgets.

Disclaimer

This content is not medical advice. For any health issues, always consult a healthcare professional. In an emergency, call 911 or your local emergency services.